Equity Backtester Platform

Overview, architecture, data flow, capabilities, and tech stack for the backtesting platform.

This document consolidates all backtesting platform documentation into a single, scrollable page. The materials cover architecture, data flow, core capabilities, and the technology stack. All content is view-only and hosted directly on this site.

This system is designed to support research‑grade backtesting and analysis of trading ideas across user‑supplied datasets, with a workflow that ingests data, executes strategies, simulates performance, and produces analytical outputs for review. It provides capabilities for data management, strategy execution, backtesting, statistical validation, macro and volatility analysis, and results comparison, including validations such as hit‑rate analysis, skill testing, survival analysis, and randomized entry tests to distinguish signal from noise. Typical outputs include trade logs, equity curves, summary metrics, and saved analysis artifacts suitable for visualization or export.

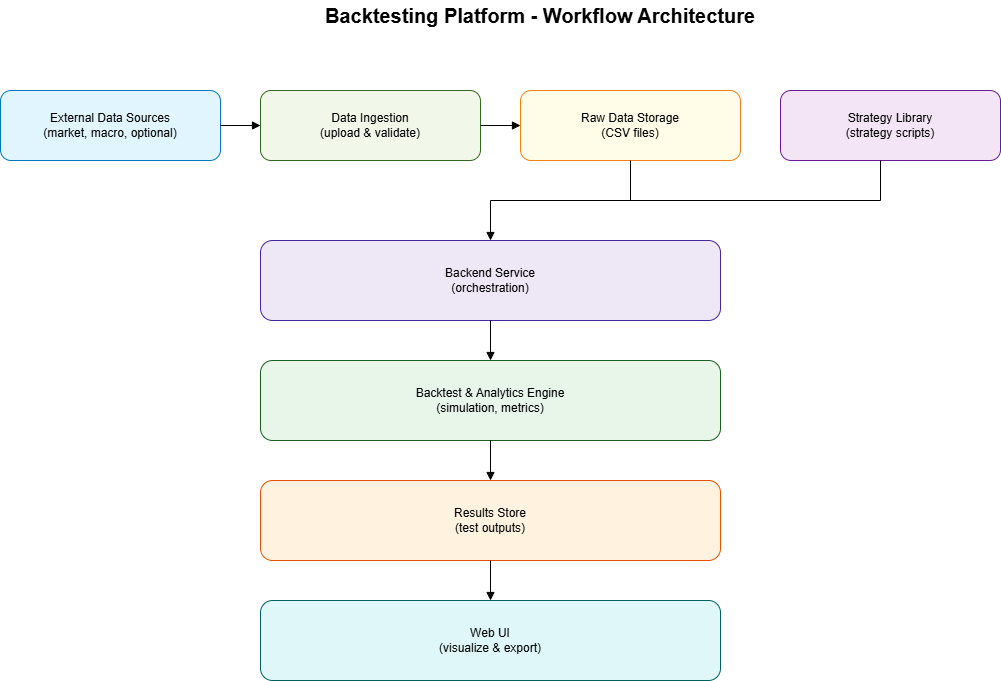

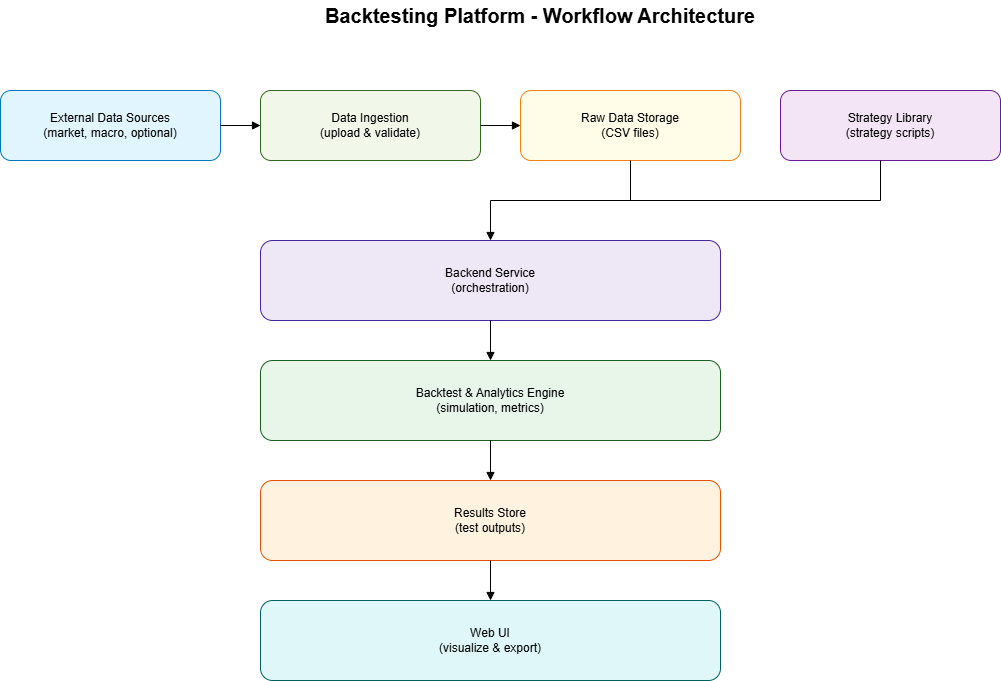

Quick visual

Architecture overview

Scope

This section describes the system-level architecture for the backtesting platform, derived from the current codebase structure and API surface.

System context (C4 - Context)

graph TB

User[Research User]

UI[Web UI]

API[Backend Service]

Files[Local CSV/JSON Files]

Ext[External Data Sources]

User --> UI

UI --> API

API --> Files

Ext --> API

Ext -. optional .-> API

Notes

- External data sources are optional and accessed via helper scripts or libraries (for example, yfinance). The core runtime uses local CSVs.

Containers (C4 - Container)

graph TB

UI[Frontend Web App]

API[Backend Service]

CSV[(CSV Store: uploaded_csvs/)]

STRAT[(Strategy Files: strategies/)]

DEEP[(Deep Test Results: deep_test_results/)]

MACRO[(Macro Test Results: macro_test_results/)]

VOL[(Volatility Data/Results: backend/volatility_testing.py)]

UI --> API

API --> CSV

API --> STRAT

API --> DEEP

API --> MACRO

API --> VOL

Component view - Backend (C4 - Component)

graph TB

API[Backend Application]

DM[Data Management Endpoints]

STRAT_M[Strategy CRUD Endpoints]

BACKTEST[Backtest Engine]

DEEP_TEST[Deep Testing Module]

MACRO_TEST[Macro Testing Module]

VOL_TEST[Volatility Testing Module]

REL_PERF[Relative Performance Module]

API --> DM

API --> STRAT_M

API --> BACKTEST

API --> DEEP_TEST

API --> MACRO_TEST

API --> VOL_TEST

API --> REL_PERF

Key backend components

- Data management: CSV upload, validation, preview, list, delete, download.

- Strategy management: save, list, fetch, delete Python strategies.

- Backtest engine: executes strategies, simulates equity curve, computes metrics.

- Deep testing: statistical tests on strategy outcomes and trade distributions.

- Macro testing: factor modeling, walk-forward validation, insights generation.

- Volatility testing: index-specific volatility analysis.

- Relative performance: ratio-based backtest between two symbols.

Primary data stores

backend/uploaded_csvs/for OHLCV and macro data inputs.backend/strategies/for user-supplied strategy scripts.backend/deep_test_results/for deep testing output.backend/macro_test_results/for macro testing output.

API surface summary (high level)

- Data management endpoints for upload, validation, preview, list, delete.

- Strategy endpoints for create, list, load, and delete.

- Backtest execution endpoints (single, multi-asset, relative performance).

- Deep testing endpoints for running tests and exporting results.

- Macro testing endpoints for factor runs, results, exports, and insights.

- Volatility analysis endpoints for index testing.

Reference diagram

Data flow and processing

This section outlines the primary data flows for the platform, including backtesting, deep testing, macro testing, and volatility testing.

Flow 1: Data upload and validation

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

User->>UI: Select CSV file

UI->>API: Upload dataset

API->>FS: Store CSV file

API-->>UI: Upload status

UI->>API: Validate dataset

API-->>UI: Validation result + preview

Flow 1a: Ingest data (key flow)

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

User->>UI: Choose dataset to ingest

UI->>API: Upload dataset request

API->>FS: Persist raw CSV file

API-->>UI: Ingest success + file reference

Flow 2: Strategy backtest

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

participant STRAT as strategies/

User->>UI: Choose CSV + strategy + dates

UI->>API: Run backtest

API->>FS: Read CSV data

API->>STRAT: Load strategy script

API->>API: Execute run_strategy()

API->>API: Simulate equity + compute metrics

API-->>UI: Trades + metrics + equity curve

Flow 2a: Compute metrics (key flow)

sequenceDiagram

participant API as Backend Service

participant Metrics as Metrics Engine

API->>Metrics: Receive trades + equity curve

Metrics->>Metrics: Compute returns, drawdown, ratios

Metrics-->>API: Metrics summary

Flow 3: Deep testing (statistical tests)

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

participant STRAT as strategies/

participant DEEP as deep_test_results/

User->>UI: Configure deep test parameters

UI->>API: Run deep test

API->>FS: Load CSV data

API->>STRAT: Load strategy script

API->>API: Execute run_strategy()

API->>API: Run deep testing suite

API->>DEEP: Save results JSON

API-->>UI: Summary + result ID

Flow 4: Macro testing

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

participant MACRO as macro_test_results/

User->>UI: Select stock + macro factors

UI->>API: Run macro test

API->>FS: Load stock and macro CSVs

API->>API: Build features + train model

API->>API: Walk-forward validation

API->>MACRO: Save results JSON

API-->>UI: Results + insights

Flow 5: Volatility testing

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

User->>UI: Select index + date range

UI->>API: Run volatility analysis

API->>API: Run volatility analysis

API-->>UI: Volatility results

Flow 6: Relative performance backtest

sequenceDiagram

actor User

participant UI as Web UI

participant API as Backend Service

participant FS as uploaded_csvs/

participant STRAT as strategies/

User->>UI: Choose stock A/B + strategy + dates

UI->>API: Run relative performance backtest

API->>FS: Load both CSVs

API->>STRAT: Load strategy script

API->>API: Build price ratio series

API->>API: Execute run_strategy() on ratio

API-->>UI: Trades + metrics

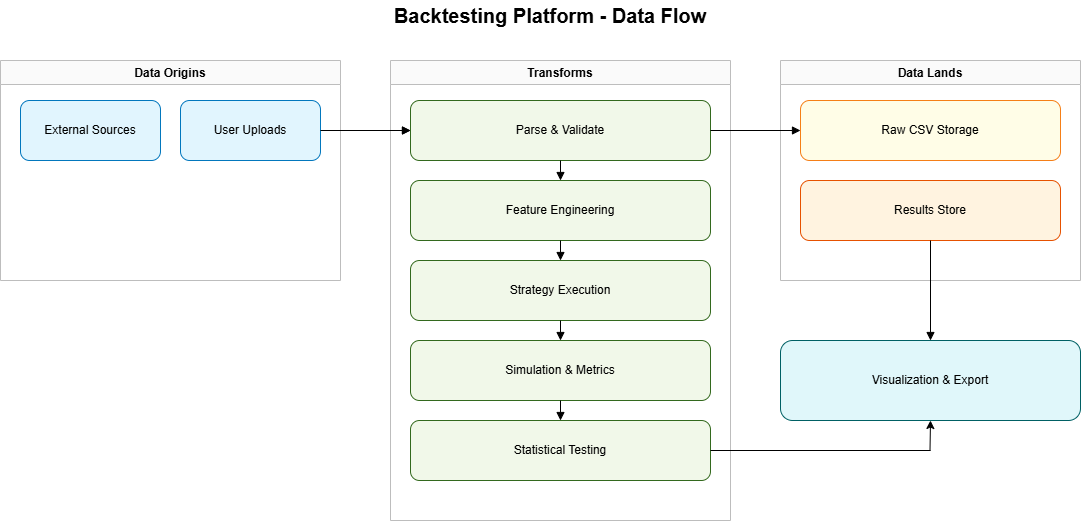

Data flow diagram (origins, transforms, lands)

flowchart LR

Sources[External Market & Macro Data]

Uploads[User Uploaded CSVs]

Raw[Raw CSV Storage]

Parse[Parse & Validate]

Feature[Feature Engineering]

Strat[Strategy Execution]

Sim[Simulation & Metrics]

Results[Results Storage]

UI[Web UI Visualizations]

Sources --> Uploads

Uploads --> Raw

Raw --> Parse

Parse --> Feature

Feature --> Strat

Strat --> Sim

Sim --> Results

Results --> UI

Data persistence overview

- Inputs are stored as CSVs in

backend/uploaded_csvs/. - Strategy code is stored as Python files in

backend/strategies/. - Macro and deep testing results are stored as JSON under their respective result directories for later retrieval.

Reference diagram

Capabilities

This section summarizes the platform's capabilities based on the current backend API and frontend workflows.

Data management

- Upload CSV files for stocks, indices, and macro factors.

- Validate CSV structure (required OHLCV columns).

- Preview, list, download, and delete uploaded datasets.

Strategy management

- Save strategy scripts as Python files.

- List, load, and delete strategies.

- Execute strategies via a required

run_strategy()entry point.

Backtesting

- Single-asset backtests with selectable date ranges.

- Multi-strategy backtests (up to 3 strategies per run).

- Equity curve simulation and performance metrics.

- Trades export to CSV.

Backtesting (1-to-n)

- Run a single strategy across multiple datasets in one request.

- Compare metrics across a set of symbols.

- Export consolidated trades.

Relative performance

- Ratio-based backtests between two symbols (stock A / stock B).

- Apply a strategy to the ratio series and switch holdings.

Deep testing (statistical validation)

- Run deep statistical tests over a strategy's trade set.

- Persist results for later retrieval, comparison, and export.

- Export deep-test reports as CSV.

Macro testing

- Test predictive power of macro, momentum, and volatility factors.

- Walk-forward validation and feature importance analysis.

- Save and load historical macro tests.

- Optional AI insights generation (requires API credentials).

Volatility testing

- Analyze volatility behavior for predefined indices.

- Run index-specific volatility analysis across date ranges.

Operational utilities

- Backend server manager for start/stop/status.

- Data download scripts for external data sources (optional workflow).

Tech stack

Frontend

- Web UI built with a modern JavaScript framework.

- Charting and visualization library for performance graphs.

- UI testing framework for component and interaction tests.

Backend

- Python service with an HTTP API.

- ASGI-compatible application server.

- Data processing and numerical analysis libraries.

- Machine learning and statistical modeling libraries.

- Plotting and visualization utilities for analysis output.

- HTTP client libraries for external data access.

- Environment configuration utilities.

- Process management utilities.

- Optional AI insights integration.

- Optional cloud SDK for integrations.

Data storage

- Local filesystem CSVs for inputs (

backend/uploaded_csvs/). - JSON result files for macro and deep testing.

- Strategy scripts stored as Python files (

backend/strategies/).

Supporting scripts and tools

- Data download utilities for market and macro data.

- Ad-hoc research utilities for macro and volatility testing.

Runtime and deployment notes

- Local development server: React dev server and FastAPI backend.

- No database layer present in the current codebase.

Disclaimer: Altus Labs is not authorised or regulated by the Financial Conduct Authority (FCA). Altus Labs is a research publication and this content is provided for informational and educational purposes only. It does not constitute investment advice, a financial promotion, or an invitation to engage in investment activity. See our full disclaimer for more information.