Options Backtester Platform

Overview, architecture, data flow, capabilities, and tech stack for the options backtesting platform.

This document consolidates the options backtester documentation into a single, scrollable page. The materials cover architecture, data flow, core capabilities, and the technology stack. All content is view-only and hosted directly on this site.

This system is designed to run options strategy backtests over historical market data, simulate pricing and risk behavior, and produce performance analytics for decision support. It provides configurable strategy execution, portfolio simulation, optimization and parameter search, and statistical validation workflows, including randomized and out-of-sample testing where configured. Outputs include trade logs, portfolio time series, risk and performance metrics, comparison and optimization summaries, validation results, and exportable datasets suitable for reporting or visualization.

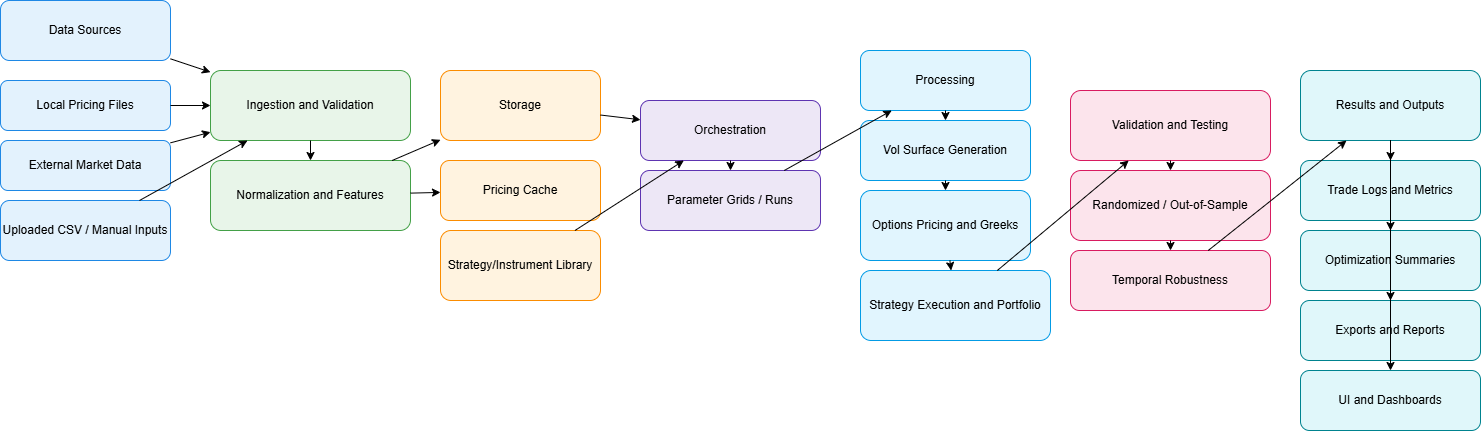

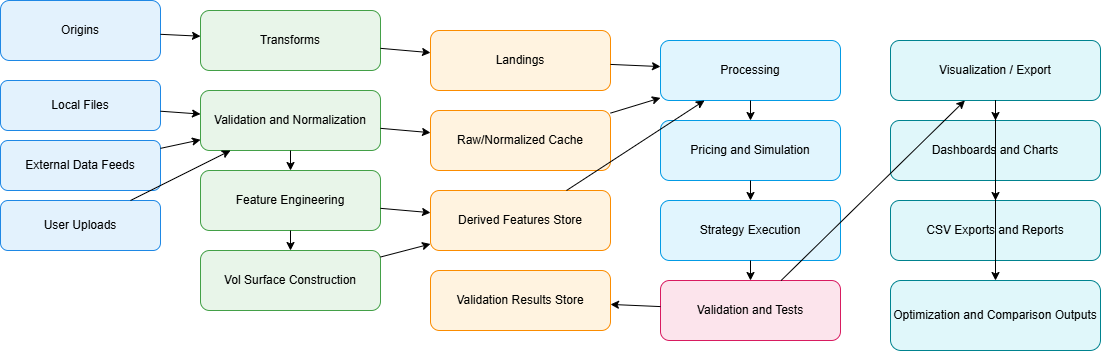

Quick visual

Architecture overview

System context (C4-style)

flowchart LR

user[User / Analyst]

data[Market Data Sources]

files[Local Data Files]

system[Options Backtesting Platform]

outputs[Results, Metrics, Exports]

user --> system

data --> system

files --> system

system --> outputs

Container (C4-style)

flowchart TB

subgraph Platform

ui[Web UI]

api[HTTP API Service]

engine[Backtesting and Simulation Engine]

analytics[Analytics, Optimization, and Validation]

end

subgraph Storage

pricing[Pricing Data Store]

results[Results and Exports Store]

registry[Strategy and Instrument Library]

localdb[Embedded Results Database]

end

user[User / Analyst]

external[External Data Sources]

user --> ui

ui --> api

api --> engine

engine --> analytics

analytics --> results

external --> engine

pricing --> engine

registry --> engine

localdb --> analytics

results --> ui

Component (C4-style)

flowchart TB

subgraph Backtesting Engine

loader[Data Loader]

vol[Volatility Modeling]

pricing[Options Pricing and Greeks]

strategy[Strategy Runner]

portfolio[Portfolio and Trade Manager]

metrics[Metrics and Risk Calculator]

end

subgraph Data Stores

market[Pricing Data Files]

outputs[Results Files]

db[Embedded Test Results Store]

end

loader --> vol

vol --> pricing

pricing --> strategy

strategy --> portfolio

portfolio --> metrics

market --> loader

metrics --> outputs

metrics --> db

High-level API surface

The API surface provides a small set of capabilities for driving workflows and retrieving outputs. At a high level it includes endpoints for data validation, backtest execution, strategy comparison, optimization and parameter sweeps, statistical validation runs, progress and status polling, and export of results to files suitable for reporting or visualization.

Data flow and processing

Data ingest

sequenceDiagram

participant User

participant UI as Web UI

participant API as HTTP API Service

participant Data as Data Layer

participant Store as Local Data Store

participant Source as External Data Source

User->>UI: Request data validation or load

UI->>API: Submit data request

API->>Data: Load or refresh data

Data->>Store: Check local cache

Store-->>Data: Cached data (if available)

Data->>Source: Fetch missing data (if needed)

Source-->>Data: Historical pricing data

Data-->>API: Prepared time series

API-->>UI: Data readiness status

Run backtest

sequenceDiagram

participant User

participant UI as Web UI

participant API as HTTP API Service

participant Engine as Backtesting Engine

participant Strategy as Strategy Runner

participant Pricing as Pricing and Volatility

participant Portfolio as Portfolio Manager

participant Results as Results Store

User->>UI: Start backtest

UI->>API: Submit backtest configuration

API->>Engine: Initialize run

Engine->>Strategy: Evaluate signals

Engine->>Pricing: Price instruments

Engine->>Portfolio: Simulate entries/exits

Engine->>Results: Persist results

API-->>UI: Return metrics and summaries

Compute metrics

sequenceDiagram

participant API as HTTP API Service

participant Engine as Backtesting Engine

participant Metrics as Metrics Calculator

participant Validation as Validation and Testing

participant Results as Results Store

API->>Engine: Request metrics

Engine->>Metrics: Aggregate trades and returns

Metrics->>Validation: Run statistical checks

Validation-->>Metrics: Validation outputs

Metrics->>Results: Store summaries

Engine-->>API: Metrics response

Data flow diagram

flowchart LR

origins[Data Origins]

ingest[Ingestion and Normalization]

storage[Local Data Store]

orchestration[Run Orchestration]

processing[Pricing and Simulation]

metrics[Metrics and Validation]

outputs[Results and Exports]

ui[Web UI and Reports]

origins --> ingest --> storage

storage --> orchestration --> processing --> metrics --> outputs --> ui

Reference diagram

Capabilities

Data

- Load historical pricing data from local files and external sources.

- Validate symbol availability and data coverage.

- Maintain local data cache for repeatable runs.

Strategy

- Execute single-strategy backtests over configurable date ranges.

- Support multi-leg instruments and position direction.

- Run multi-strategy and multi-asset comparisons.

Analysis

- Compute performance, risk, and trade-level metrics.

- Provide portfolio time series for visualization.

- Generate optimization outputs across parameter grids.

Validation

- Run statistical checks including drawdown and risk metrics.

- Perform randomized and out-of-sample validation workflows.

- Produce alpha validation and robustness summaries.

Exports

- Export trades, results, and analyses to tabular files.

- Provide datasets suitable for charts and dashboards.

- Persist optimization and validation outputs for reuse.

Tech stack (generic)

- User interface: A web-based UI for configuration, execution, and visualization of backtests.

- API layer: An HTTP API service exposing high-level operations for backtesting, optimization, validation, and export.

- Computation runtime: A scripting runtime that orchestrates data loading, pricing, strategy evaluation, and metrics generation.

- Data processing: Numerical and tabular processing utilities for time-series calculations, risk metrics, and aggregations.

- Storage: Local file storage for pricing data, results, and exports, plus an embedded database for curated test records.

- Reporting: Exporters that serialize results into portable tabular formats for further analysis or visualization.

Disclaimer: Altus Labs is not authorised or regulated by the Financial Conduct Authority (FCA). Altus Labs is a research publication and this content is provided for informational and educational purposes only. It does not constitute investment advice, a financial promotion, or an invitation to engage in investment activity. See our full disclaimer for more information.